Early-stage funding in India is broken

What should startup founders understand before raising early-stage capital in India?

Namaste Dear Reader,

I have been thinking about the role that early-stage investors play in a startup's journey. Let me begin to explain my headline by asking you this: What should the KPI be for early-stage investors?

Connections/ Opening doors: Investors usually introduce young founders to customers, vendors, and employees and accelerate processes at startups

Assisting in operations/ admin: Some VCs help their portfolio companies with non-core activities

Helping raise the next round of capital: Early investors have a clear interest in nudging the next set of investors toward their startups

While all the above are important, I believe, none of them are the true north star. The core KPI of an early-stage investor is to help startups find PMF – Product Market Fit. Explained simply, finding PMF is to discover a profitable & repeatable method of serving an adequately large market with your product/ service.

The role of a founder is to convert early-stage funding into PMF &

the role of an early investor is to do everything possible to assist the startup in achieving this.

So well what’s the problem – given that the Indian market, at least, at the early stage has capital and ‘value-add’ VCs aplenty?

The problem today is not the inadequacy of funding dollars, but rather the nature of funding available.

Consider this – a VC fund’s lifecycle is usually 10 years (+ extensions) in India. Funds investing at an early stage are gunning for 50 to 100x returns given the high mortality risk of early startups. Thus, a VC will want a startup to grow rapidly within a short period of time for it to be successful.

There are two key factors for a founder to understand when seeking early-stage VC funding and it is important to consider these in the context of finding PMF:

Time pressure:

VCs want the startup to grow as large as possible within a concentrated period of time. However, this is not practically possible unless a startup truly has found PMF.

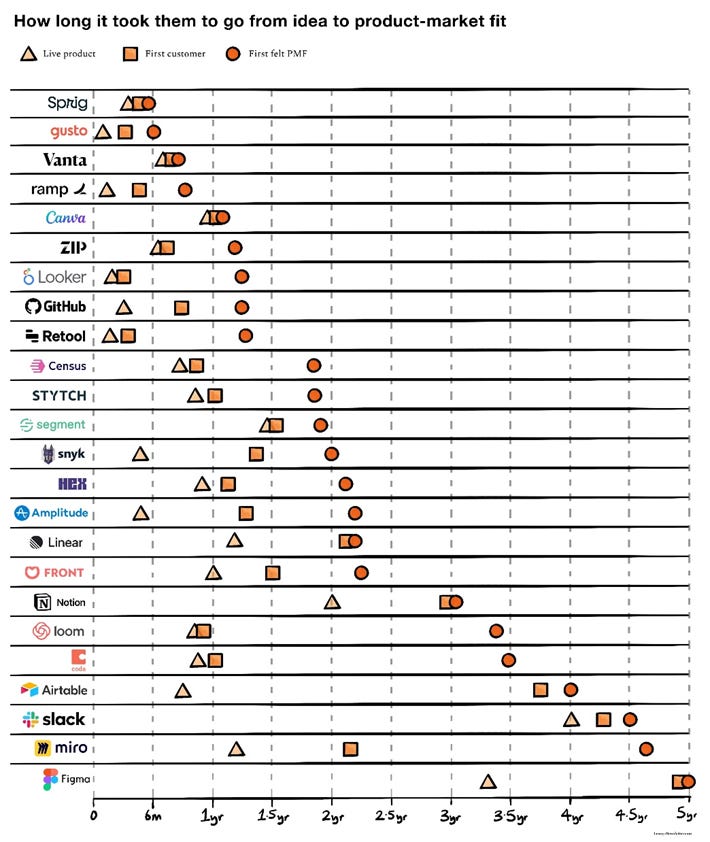

Consider the below chart shared by Lenny Rachitsky, on finding PMF

As per the above, the median time from idea to feeling product-market fit was roughly 2 years. However, most of the examples shared here (in hindsight) are top-decile B2B companies. Even then there are several examples above that took longer than 2 years for them to fit a VC’s timeline to enable the company for its next fund raise. My experience is that the median time is generally much longer for the average startup!

Also, consider this, most VCs expect the startup to raise the next round within 18-24 months. This may result in the founder spending money on sales and marketing to buy revenue without truly figuring out PMF and the right channel for its GTM strategy

Scale pressure:

As I have shared before in my post on ‘Is my business ready for venture funding?’, the scale benchmark used by seed-stage VCs is $100 Mn or Rs ~800 cr in revenue, a demanding ask for most companies. India does have a much more wholesome and robust infrastructure in place today, however, the fact remains that there are not enough cash pools (yet) for businesses to scale sustainably to such a high number.

Going after scale without clear PMF creates startups addicted to capital and eventually results in a pool of startup founders who have the wrong incentives to attract further investor money.

Seeking VC funding before PMF:

As explained above, the nature of VC funding can create the wrong incentives for a startup, especially if the startup does not have PMF.

The objective of this post is to not suggest that startups not seek external money at the early stage but rather that founders understand the implications of raising VC money.

I love this paragraph that Charles Hudson of Precursor Ventures, recently shared:

The investors want to see a path toward an outcome that works for their funds and returns models. The founders are often focused on making sure that their companies are viable and can survive to continue to fight to see another day. For many founders, survival is both necessary and sufficient; they want to keep going and fighting with the optimistic belief that they will find a big opportunity. For many VCs, portfolio company survival is necessary but not sufficient; the VC model doesn’t work well if portfolio companies survive and stay alive but don’t grow or turn into successful exits.

To visualize the above quote in my chart:

Concluding thoughts:

As stated, I am not dissuading startups from raising early capital from investors. However, founders must understand the implications of raising early-stage venture money.

In some markets/ sectors, one can make a case that raising VC money from day zero is crucial as the opportunity may be lost/ surrendered to competition. While there is some merit to this and every opportunity has its nuance, I’d broadly counter-argue that if capital is the moat for a business, then is it really a business you want to be building where you are reliant on the conviction of external investors?

Here are some questions for founders to consider before raising early-stage capital:

How close am I truly to PMF?

Seek patient investors who understand and empathize with your path toward finding PMF

Does external capital help accelerate its discovery?

Take capital to run experiments on hypotheses built on actual business data. Don’t take capital to form your hypothesis

What is the true achievable scale for my business?

The chance of building a business that does Rs 100 cr to 500 cr revenue in 8 to 10 years is much more practical than a company doing Rs 800 - 1000 cr revenue. Be clear about your desired outcomes with VCs

Ultimately, remember, the goal of any business is to build maximum enterprise value with limited external dilution.

Raise external capital in a manner that reflects the timelines of the opportunity presented to your business and not your VC’s timeline!

I hope this post helps Indian founders understand the implications of seeking early-stage funding VC funding, especially before PMF!

I would love your (anonymised) feedback! Do share your comments & questions below or write to me @SaneDhruv on Twitter

While there is some merit to this and every opportunity has its nuance, I’d broadly counter-argue that if capital is the moat for a business, then is it really a business you want to be building where you are reliant on the conviction of external investors?

* this thought although simple is interesting, i believe the right answer needs to be to take the biz from 0 to 4/5, but needing capital to take it to 10 within the same time period it would have for 4/5.

also just to form a chain of events- if capital is the moat, then basically your thesis is first mover advantage

now assuming for a second this works out and you are the first mover, in the longer term wouldnt the execution matter, meaning that the player that executes better will slowly takeover the market anyway, no matter who the first mover was.

this was the ideal case anyway, and with first mover you are basically hoping that someone with deeper pockets wont disrupt you.

for eg- swiggy started with delivery platform 1yr before zomato, but it seems with better execution zomato controls a larger gmv, maybe a very crude example but the significance is that execution can break the first mover moat.

a similar thing happened in the RPET recycling story, Srichakra was the first in india to get into this and setup the whole demand value chain and infra, but somewhere along the way they lagged and ganesha eco captured the market, entering it much later.