Is my business ready for venture funding?

Views on how VCs qualify startups for funding and key considerations

Namaste Dear Reader🙏,

Thank you for the overwhelming response to the first edition of The Sane View! The objective of this newsletter is to answer simply the hard questions which bog the minds of early Indian founders. If you have a question that you’d like me to answer, simply hit reply to this email or DM me here!

Venture capital is still a relatively new concept in India and has undoubtedly ushered a new wave of entrepreneurship in our country. We are witnessing an era, where incubators & accelerators accept applications from aspiring founders even before they have a credible business idea or even a co-founder! Media-fuelled fascination with venture-funded startups and the numbers quoted has resulted in many a founder viewing VC money as the default option for building a business.

However, the cold truth of the matter is that venture capital, as a financing option, is only suitable for a very small percentage of new businesses in the country.

So, is your idea/ business eligible for VC funding?

Here is a key heuristic, founders can use to understand whether their business qualifies for VC funding:

Let’s expand on the above:

Q. Is your business disruptionary?

This question looks fairly obvious in the sense that if a business has to achieve the next two benchmarks, it needs to disrupt an existing market or create a new one! Yet this is a What + How question, which essentially forms the base of building an investment case!

The question has two parts in my view:

What is the anticipated shift (either in tech, human behaviour, macro, or regulatory change) that the business hopes to exploit?

How is the founding team going to do so?

A key part of VCs building their conviction on the deal is really buying into the founding team’s vision of riding a forthcoming wave! Investors are looking to seek an ‘Aha’ moment in the narrative built by a founder.

This leads to investors providing funding to some truly extraordinary businesses while also some plain duds!

Q. Is your business building for a 100x opportunity?

It’s tempting to say ‘Yes’ to this question if you are a founder, but in reality, only a handful of businesses are true 100x opportunities. I am defining a 100x opportunity as one with the potential to generate $100 Mn or Rs 800 crore in revenue 😊

$100 Mn is a rough benchmark used by seed-stage VCs to screen potential candidates.A logical manner to answer this question is to understand and assess the underlying market (or the problem being solved). Although, the exercise will seem largely academic, it is worthwhile spending some time understanding the Total Addressable Market (TAM) for your business whilst accounting for competition and industry dynamics.

How do you go about doing this, especially in a case where a business is a category creator? Assessing your TAM will require its own post, which I hope to cover separately!1

One may argue that large businesses are built over a period of time with the founders identifying and subsequently upselling existing customers or entering adjacent markets through building more feature sets/ solutions. However, this is easier said than done – moreover such kind of expansion inherently requires a lot of time which brings us to our next question

Q. Can you achieve Rs 800 crore of revenue in 8 years?

Again, before you answer, let me share some examples of venture-funded “success stories”, to bring perspective to the above criteria:

Zomato crossed the Rs 800 crore mark in FY-2019, roughly 8 years after it raised its first institutional cheque from Naukri (Info Edge) in 2010

PolicyBazaar achieved a turnover of Rs 887 crore in FY-2021, about 12 years after raising their cheque from Naukri (again!) in 2008

CarTrade is run rating at about Rs 400 crore of annual revenues in 2022 after raising its first round from Tiger Global and Canaan Partners in 2011!

Undeniably, India does have a much more wholesome and robust infrastructure in place today as compared to when these companies were starting out and we are surely in India’s internet era, the fact still remains that is difficult to build mammoth businesses in under a decade. Mind you, we are only referring to only the success stories here and not the mass of failures of venture-funded companies!

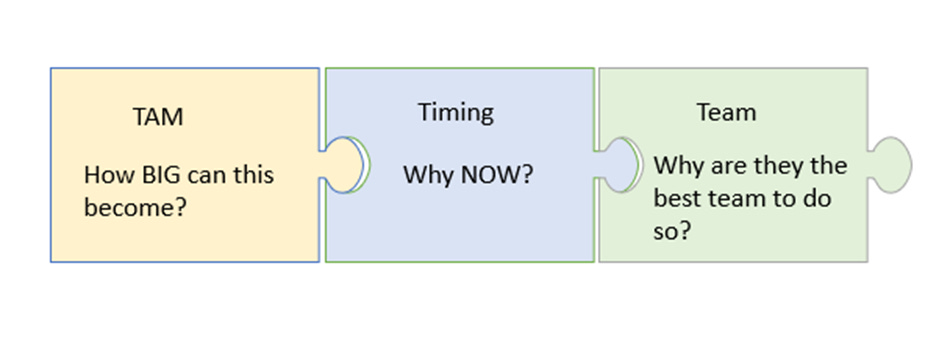

Another way of looking at this is: VCs are fundamentally looking to build conviction on the famous trifecta (TTT): Team, TAM, and Timing!

If a founder answers all of the above, he/ she will realise whether the business is a prime candidate for venture funding.

More often than not, if one is honest, the answer will likely be NO!

So, what should a founder do?

Time for a simple mental exercise in Vedanta:

Climbing a mountain

Imagine you and several others are asked to climb to the top of a mountain. There are several paths that one can take:

A near-impossible path that involves a vertical climb, but is the shortest way

A slower path through the forest but with a danger of wild animals

A slow, tiring, winding path across the mountain to the way up

Which one will you take?

…

Now, you may choose a path and also logically rationalise your answer in some way whilst declining the other choices. However, there is one thing can you cannot deny - the paths are many but the peak is one

Moral: It doesn't matter which path you take. The only person wasting time is the one who circles the mountain announcing that everyone is on the wrong route.

The allure of raising venture capital will always exist, but remember as a founder your primary job is to get to the peak i.e., build a profitable business – not quibble about the path!

The likes of Zerodha and Zoho are testament to the fact that large businesses can be built without VC funding!

I leave you with one last question before I conclude this piece, which I believe is more critical: Before asking whether your business is the right fit for VC, ask this,

“Am I or my co-founders ready to raise venture funding?”

· Give up part ownership/ part control of your business?

· Willing to scale super-fast and bear the added pressure to perform?

As the Indian ecosystem matures, I believe that we will witness more financing mechanisms to start a new business instead of the present perceived duopoly (VC vs bootstrapping).

Check out the Calm Fund, which offers a Shared Earnings Agreement (“SEAL”) that allows us to back founders who want to build sustainable profit-focused businesses without the pressure of having to continually raise capital or sell!

We need more such financing mechanisms in India as well!

Final TLDR, Rounding up my thoughts:

Key benchmarks for VC funding: Disruptionary business + Achieve Rs 800 crore in revenue in 8 years

Study and map out your market, assess your GTM, and flesh out your unique perspectives

There are several paths to Nirvana!

I hope this post helps Indian founders understand the high rejection rate in VC funding and the broad benchmarks involved!

I would love your feedback! Do share your comments & questions below or write to me @SaneDhruv on Twitter

If you would like to read a post on how VCs think about a market size/ TAM - drop a comment below