Indian VC: Still seeking validation from the West?

A Sane View of Indian Venture – April & May 2023, Bi-monthly roundup of the Indian venture capital ecosystem

Namaste Dear Reader,

As Indian equity markets soar near all-time highs, I am back with this series pondering on the state of Indian VC over the last 2 months.

Over the last few days, two key events have been at the centre of Twitter storms across the tech ecosystem:

Sam Altman’s remarks on India building its own version of Open AI

Sequoia’s announcement to split/ let go of its India arm

These discussions have raised some valid questions as well as over-the-top reactions. Largely it boiled to this contention:

Indian VCs do not fund moon-shot ideas like the Americans

My humble submission is as below:

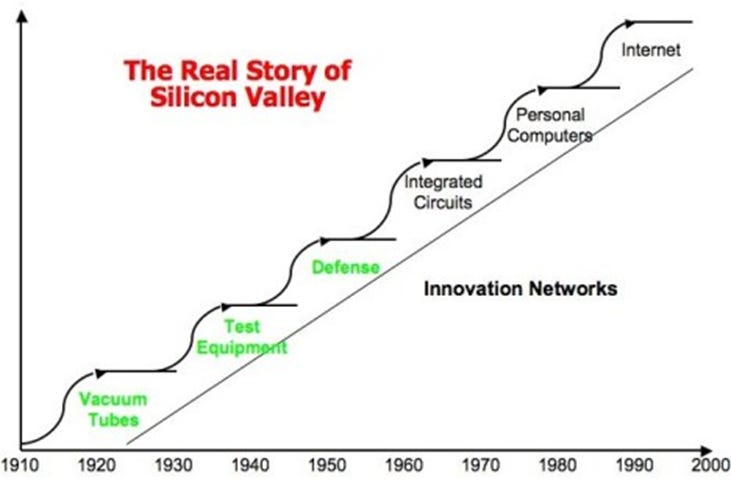

Some context is required. The US venture industry has had a head-start of at least 40 years built atop flourishing Silicon Valley’s innovation networks going way back to the 1920s. It's essential to note that the US government/ military played a crucial role in funding and supporting early Silicon Valley startups, while private venture capital firms emerged as a separate and complementary source of funding. The 1975 ERISA reforms further accelerated LP funding available for venture capital.

More importantly, the VC model in Silicon Valley has a demonstrated history of producing a series of exits for LPs:

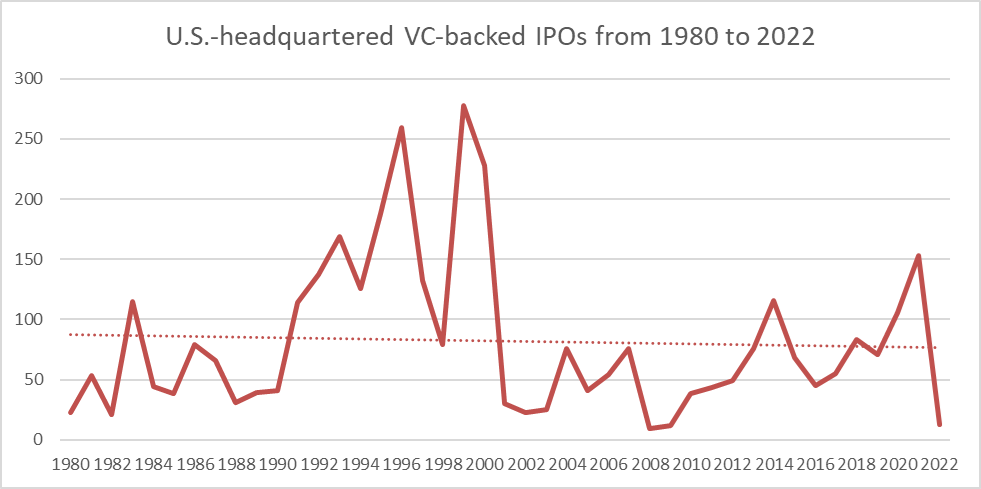

US venture capital-backed startups have delivered 3662 IPOs from 1980 to 2021 i.e. a median of 66 IPOs every year!Of the 3500+ IPOs, how many have truly been moon-shots? I’d argue less than 1%, however, what these IPOs enabled was a regular source of validation for these companies to be built over time and enabled VCs to make bolder bets.

In my opinion, building a series of IPO-able companies with a certain cadence is the only way for the venture-fly wheel to truly start turning in India.

Our aim as founders & investors, over the course of this decade must be to build & back meaningful companies which can list on the board. Along the way, we will have our moonshots.

Key developments in Indian venture across April & May 2023

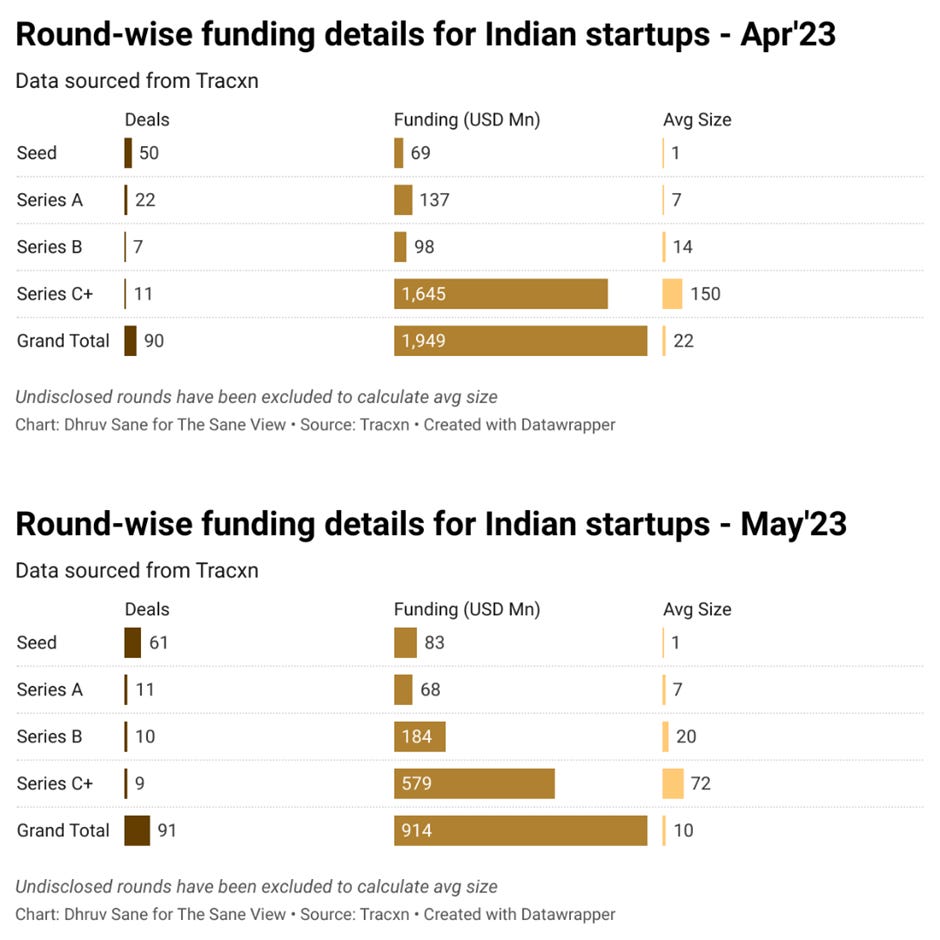

The last 2 months largely followed this year’s trajectory:

Around ~200 startups raised Seed plus rounds across the 2 months

April 2023 saw a huge bump in Series C+ funding primarily due to 3 rounds: Byju’s $700 (?!) Mn raise, DMI Finance raising $400 Mn while Ola Electric picked up $300 Mn

The venture market returned to this year’s funding monthly mean of $1 Bn in May

A deal that caught my eye: Atomberg:

The smart-fan maker netted $86 Mn in its Series C round led by Temasek and Steadview. It is great to see a consumer appliances brand make a mark in a space that appeared to be congested and not big enough for VCs previously.

Critical to note that the company only raised close to ~1 Mn in 2016 after being founded in 2012 before plugging away for 3 years until it raised its Series A of $10 Mn in 2019. The company grew its revenue from Rs 1 cr in FY16 to Rs 37 cr in FY19. Today, Atomberg derives 70% of its sales through offline channels and 30% through online sales. It clocked sales of Rs ~350 cr in the year-ending March’22

The company has now ventured into mixer grinders and smart locks. It plans to diversify further into kitchen chimneys, cooktops, amongst other categories. Atomberg’s journey ahead will be one to watch!

Closing reflection:

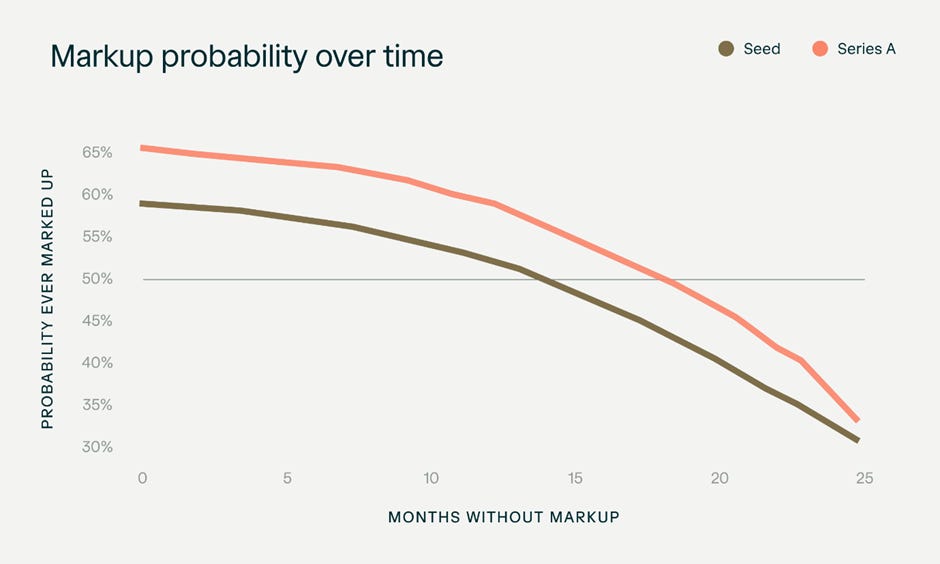

AngelList shared this tantalizing stat in their latest quarterly report:

If a seed investment has not been marked up (raised a follow-on round) within 12 months, it is more likely to NEVER be marked up than to be marked up. This period for a Series A startup is around 18 months.

AngelList surmised that markups (or a lack thereof) can be an early predictor of the outcome of a startup investment.

While this is statistically likely true, I worry about the kind of signal such an analysis provides to a founder or early-stage investor. Essentially, the inference is to push startups to go all out after growth and raise their next round as soon as possible. However, this may also destroy the non-zero chance that a startup may have had, provided it followed the ‘nail it before you scale it’ approach.

I firmly believe that every startup charts its own course and there are examples on both ends of the spectrum. There is no single path to Nirvana! Atomberg’s story above is a great example!

That’s all from my end for this post – Do let me know your views on this format. I’ll be happy to incorporate new sections basis reader-feedback. Also, do share the post within your network if you found it useful!

I would love your feedback! Do share your comments & questions below or write to me @SaneDhruv on Twitter