Massive drop in funding for Indian startups: More pain ahead?

A Sane View of Indian Venture – June & July 2023, Bi-monthly roundup of the Indian venture capital ecosystem

Namaste Dear Reader,

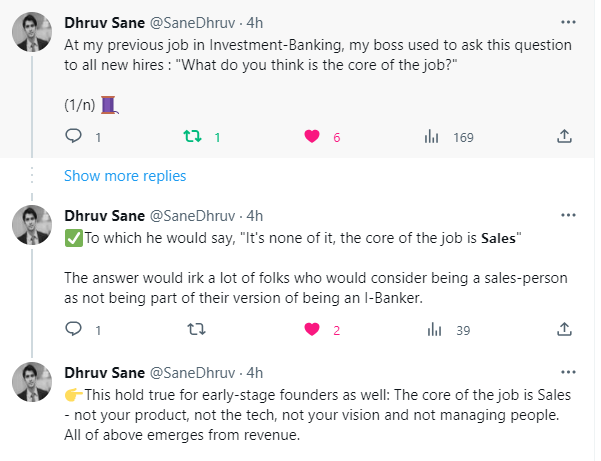

Welcome to this edition of the bi-monthly roundup of all things India VC for June & July’23. For startups, 2023 is being labelled as the ‘Year of Efficiency’ with a ‘Focus on Operational profitability’. We have had a slew of startups claim they have achieved EBITDA+ positive numbers in these last two months. The fact that we’ve made buzzwords out of Efficiency (The only advantage that startups have over incumbents is their rate of iteration and efficiency) and Profitability, is proof enough that this is a much-need reset for the startup ecosystem.

I am long-term bullish and short-term cautious about Indian startups.

Key developments in Indian venture across June & July 2023

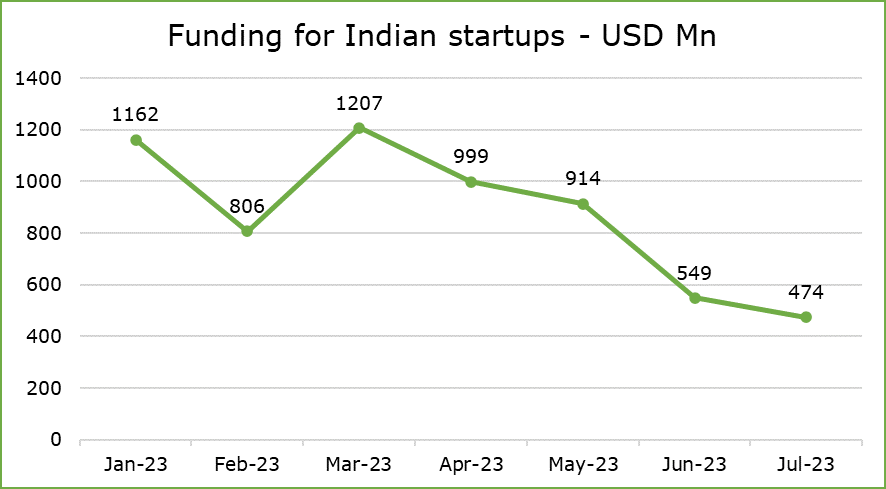

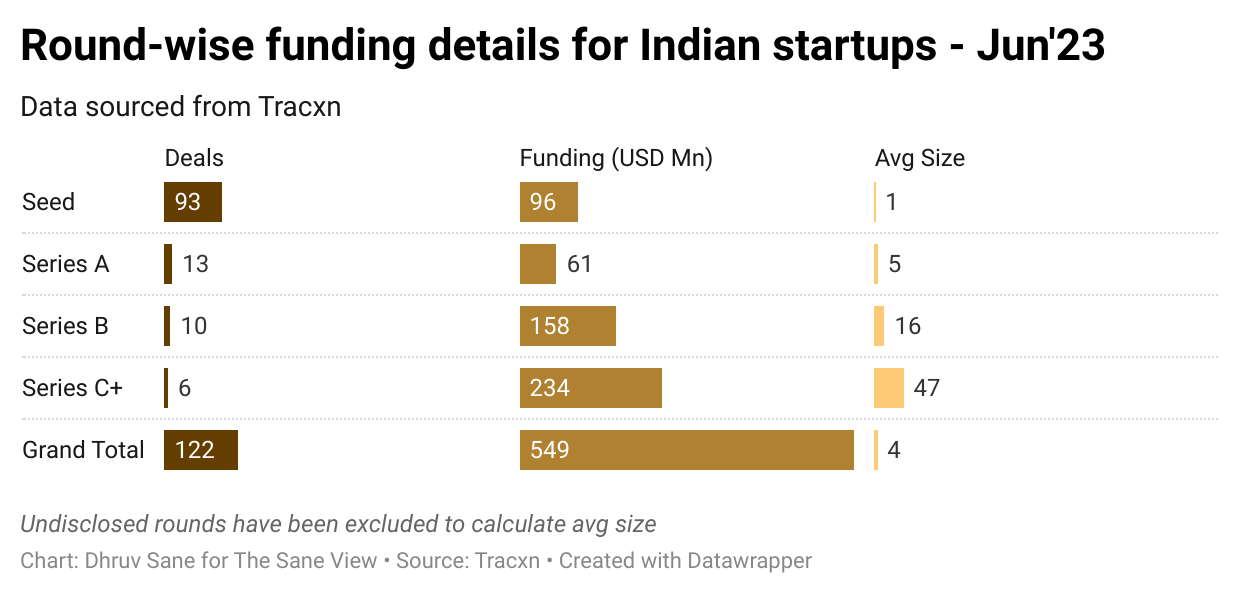

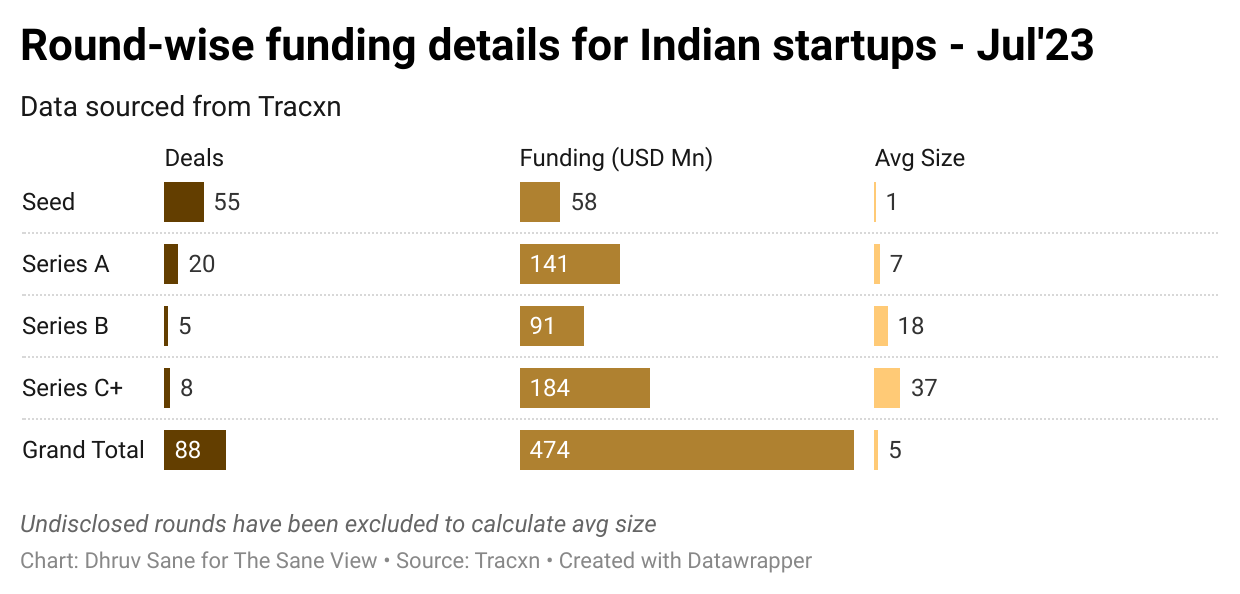

June and July saw a massive plunge in funding with startups only managing to raise roughly USD 500 Mn each month:

Late-stage funding remained on a downward spiral with disclosed Series C+ rounds accumulating only $420 Mn across the two months. For context, May’23 saw Series C+ startups raise $580 Mn in a single month alone. Interestingly, seed rounds also saw a drop in July, almost halving from the previous month.

So, how should startups raising large rounds understand whether they are eligible for investment?

Historically, raising $10 Mn+ rounds has been in companies that have both the following figured out:

Visible PMF reflected in numbers

A clear path to building a company with $1Bn in terminal value

What changed in the ‘Zero Interest Rate’ regime was that the ($1 Bn) terminal values were seen as achievable for companies that simply demonstrated high growth and a potentially large market. This has reverted to:

$1Bn in terminal value = Path to $100 Mn in sustainable revenue with operational profits.

In my view, companies that can demonstrate both of the above will not face an issue with raising their rounds (at lower valuations, yes), the rest simply won’t.

Deals that caught my eye

Lenskart’s $100 Mn raise from ChrysCapital was the largest round in these last 2 months. This raise is an extension of last year’s round and provides significant liquidity to existing investors, a much-needed respite in these times.

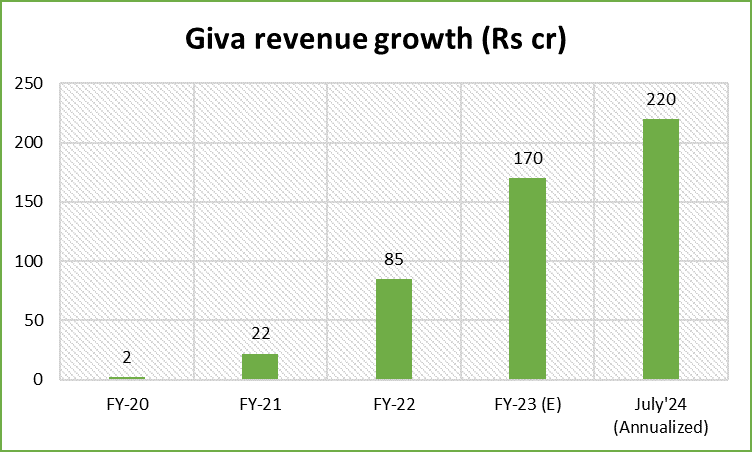

Giva Jewellery raised Rs 200 cr ($25 Mn) in a Series B round (mix of primary & secondary) led by Premji Invest. The company was amongst the first to focus on silver-based jewellery rather than gold and has grown at a very strong pace since its founding in 2019. Today, Giva is an omnichannel jewellery brand that sells across third-party platforms, its app and offline stores. The company plans to increase its store count to ~ 300 stores from 50 presently, by the end of the year. Giva competes with the likes of Tata-backed Karatlane, Melorra and BlueStone in the Indian online-first jewellery segment

Lenskart and Giva are great examples of founders identifying opportunities with a large market and the absence of significant organised players. Both have done well, transitioning from online-first brands to a more omnichannel presence.

My closing thoughts:

A lot of the conversations that I have with founders these days include remarks such as ‘VCs are taking a lot of time to get back’, ‘I am not sure whether my existing investor is going to back me’, ‘Investors are adding a lot of terms & conditions to the deal’, and several more in the same vain.

While everyone wants to will away the downturn, there is likely to be pessimism in the markets for the foreseeable future. As a founder, the single-most important thing today is to get to a default alive state first and be in control of the destiny of your business.

Again, my submission is simple – let's be short-term cautious and long-term bullish about Indian startups.