How much Venture Capital is too much/ too less for India?

Reflecting on the importance of VC and its volume

Namaste Dear Reader,

The last few years have been quite tumultuous for everyone in the startup ecosystem. From the post-Covid boom in tech-led companies and heady heights of unicorns emerging every week in 2021 to the incessant news of layoffs and down rounds in early 2023, the VC industry has had its fair share of supporters and detractors.

The industry is structurally one which seeks to and does attract attention. VC funds do a fair bit of PR to attract the best entrepreneurs as well as future funders for their investments - success is tied to funding the best talent and positioning the investment as a doorway to a large industry leader/ creator.

VC investments often fall in the “Love it, Hate it, but you can’t ignore it” category!

Recent news on company frauds, mass layoffs, alleged unethical practices and Adjusted EBITDAs have soured general sentiment towards VC in the country

However, the role of VC money in creating new companies and encouraging new entrepreneurs is undeniable. As India grows to become a $ 5 Tn economy, venture capital is poised to play a crucial role.

One may be tempted to scoff at the statement, however here are some key findings from this excellent study to ponder over:

As of the end of 2020, among public companies founded within the last fifty years in the US, VC-backed companies account for half in number, three quarters by value, and more than 92% of R&D spending and patent value.

The 1975 ERISA reforms in the US , as the study observes, allowed pension fund trustees to invest in the “alternative" asset space for the first time. This really allowed the VC industry to flourish and spur an era of innovation and growth. The trends in the total market capitalization of VC-backed companies confirm the secular rise - from 1% during the ERISA era to 3% in the 1980s, 10% in the 1990s, 17% in the 2000s, and a staggering 41% of US market capitalization in 2020.

In other developed countries (other members of the G7 - Canada, France, Italy, Germany, Japan, and the UK), pension fund trustees and other managers of substantial long-term capital, such as insurance companies and bank trusts, remained, for all practical purposes, barred from investing in private and illiquid assets.

Check out the below chart which shows the number of companies in the current top 300 public companies from the US and the top 50 public companies from the six other G7 countries (Canada, France, Germany, Italy, Japan, and the UK) founded in each decade from the 1900s onwards.

The impact of VC from the above chart in the study is clear: The US has undergone a surge in the founding of successful VC-backed companies created in the 1980s,1990s, and 2000s. This surge overwhelmed the decline in non-VC-backed US companies and led to the number of current top US companies formed in those four decades being higher than in any of the prior decades.

The other G7 nations experienced almost none of that uplift. Instead, they experienced a decline in public company formation with only a tepid rise in VC- backed companies.

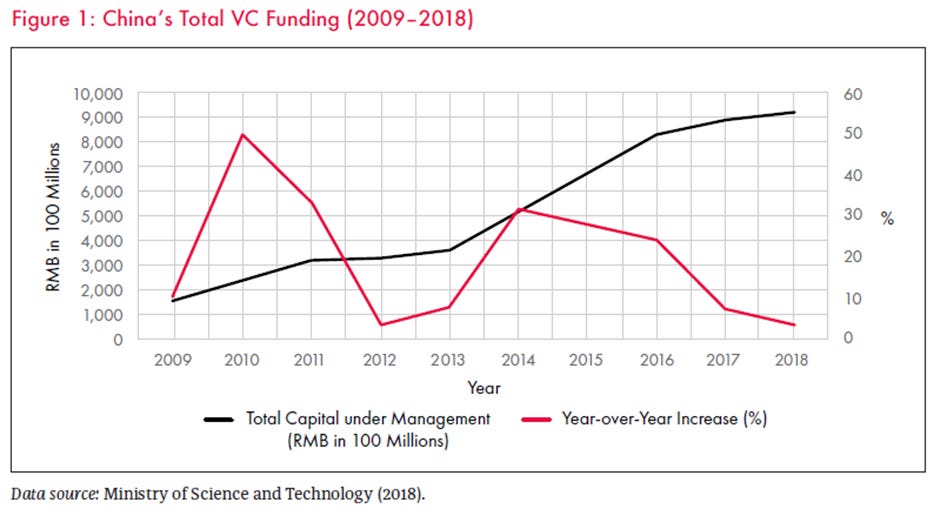

Another fact to consider is that the Chinese government, which is usually averse to aping foreign models, realized early the importance of developing an industry that fosters innovation and encouraged venture capital in its country. So much so, that local and regional governments in China set up their own venture capital shops to promote entrepreneurs in their region.

So, what does that mean in the Indian context?

India is already the 3rd largest VC ecosystem in the world and home to 100+ unicorns already! Funding in India has grown at a tremendous rate over the last 5 years, before seeing a slowdown in 2022 and 2023YTD

I shared in my January roundup, that Indian startups continue to pull in around a billion dollars every month.

One question which popped naturally was “Is this the right number?”. Are we under-investing or over-investing in future companies?

VC Funding and GDP

VC funding is inextricably linked to betting on future growth and GDP is perhaps the easiest measure to understand this in the context of a nation. Hence the metric VC Funding/ GDP is a good way of understanding under-investment or over-investment.

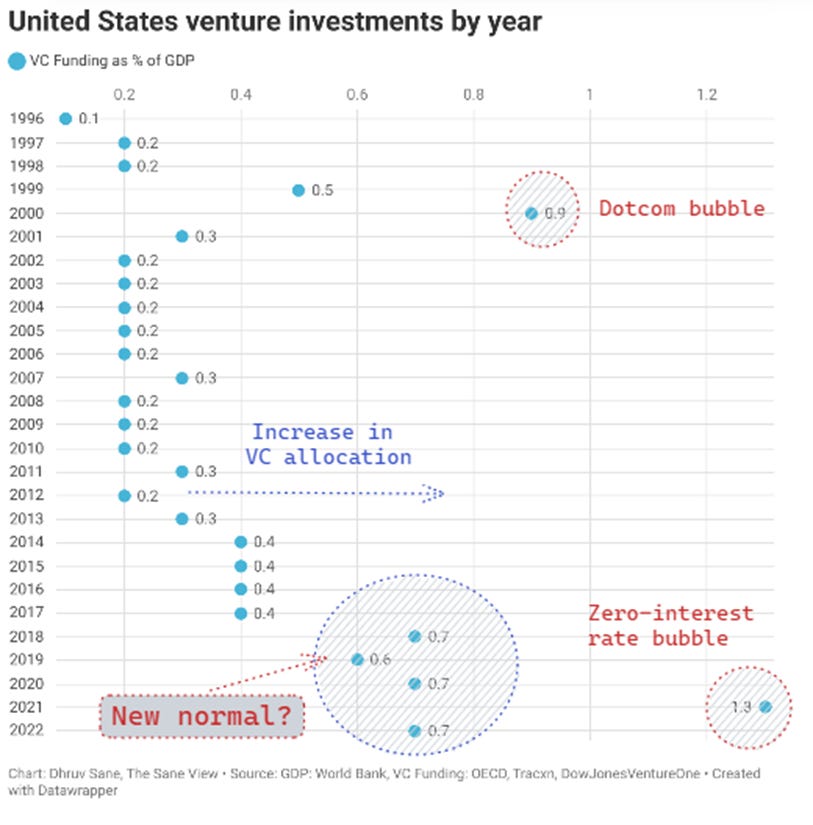

The US Venture capital industry is the most well-chronicled of all counterparts and I looked at data from 1996 onwards to cover 25 years + of data.

For the initial 15 years, VC investment remained range-bound around the 0.2% mark. From 2014 - 2017 saw a steady increase to 0.4% while VC investments increased to the 0.6-0.7% range from 2018 onwards as big became bigger!

2018 was also one of the best years for M&A and IPO activity, notably some of the high profile companies including GitHub, Qualtrics, Flipkart in M&A and Dropbox, Tenable, and Spotify on IPOs

The above chart also clearly shows the outliers - the 1999 dotcom bubble and 2021’s Fed-infused zero-interest rate bubble.

So, the million (or perhaps billion?) dollar question is whether the 0.7% VC Funding to GDP ratio will hold in a near-recessionary world following the interest rate hikes across the globe?My view is that it likely will, subject to a short-term drop:

VC investments have seen a secular rise in allocation over the years - with Software truly eating the world. The rise of technology firms as % of market cap across the globe is a testament to their cash flow potential

Record levels of dry powder with investors will ensure that there is no significant drop-off in VC funding over the next couple of years

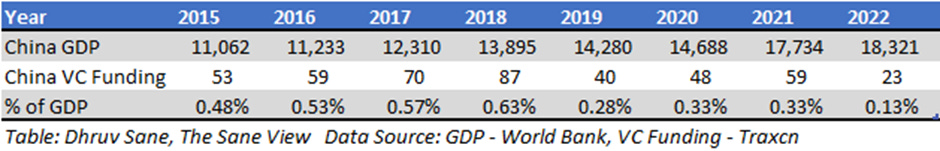

China’s numbers were also broadly in the 0.5% to 0.6% range before the Trade war between the US-China commenced in 2019.

From India’s perspective, there is good news for founders:

Given the expected growth, a conservative ratio will be one that matches US funding/ GDP rates (~0.7%) over the last 5 years. Assuming a USD 3.5Tn economy in 2023, Indian startups should haul in about $24 Bn over the year i.e. 2x the present rate – This number is lesser than the ~ $41 Bn invested in 2021 but much higher than 2020 (~12 Bn).

It is clear we over-indexed in 2021 in VC, much like the rest of the world!

While VCs on average have been deploying about a billion dollars a month, I believe this number will steadily pick up over the course of this year.

I’ll conclude this piece by reminding all of us that VC in India is a very nascent industry- investors only started deploying more than a Billion dollars a year in 2011. There will be mistakes along the way as we have seen in the excess of 2021 and parts of 2022.

However, If you broadly Long India, you can’t not be Long VC.

From a billion dollars a year (in 2011) to a month (current rate) in VC investments, we have traversed a long path and have an even longer runway to grow!

I’d love to hear your feedback and critique of this essay. Hit reply to this email or Dm me here. Do subscribe for future posts!