A Sane View of Indian Venture – January 2023

A monthly roundup of the Indian venture capital ecosystem

Namaste Dear Reader 🙏

Commencing January this year, I plan to share a roundup of all things venture every month and my commentary on it. I believe this series will be useful for founders, VCs, and enthusiasts of the Indian startup ecosystem alike. While globally (especially the US), the venture ecosystem is covered extensively, I believe there is a shortage of good aggregated sources for the Indian ecosystem.

What will this series cover?

A running commentary on the state of Indian VC

Funding trends

Deals that caught my eye

Best pieces I read on the Indian ecosystem

If the above is your cup of tea, do join me on this ride and subscribe for future posts!

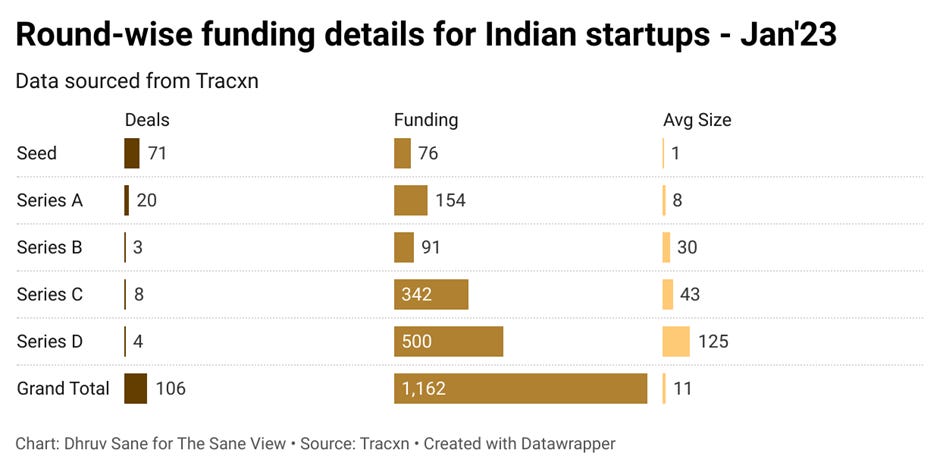

Over 100 Indian startups raised $1.2 Bn in January 2023, trending in line with the monthly average over the last few months since the onset of the funding winter:

Key stat: Extension round

35 companies raised Series A to D rounds in January. Looking more closely at the data I noted that around 10 companies actually raised extension rounds. Extension rounds usually involve the infusion of additional funding from existing or new investors typically at the same terms and valuation as the previous financing round.

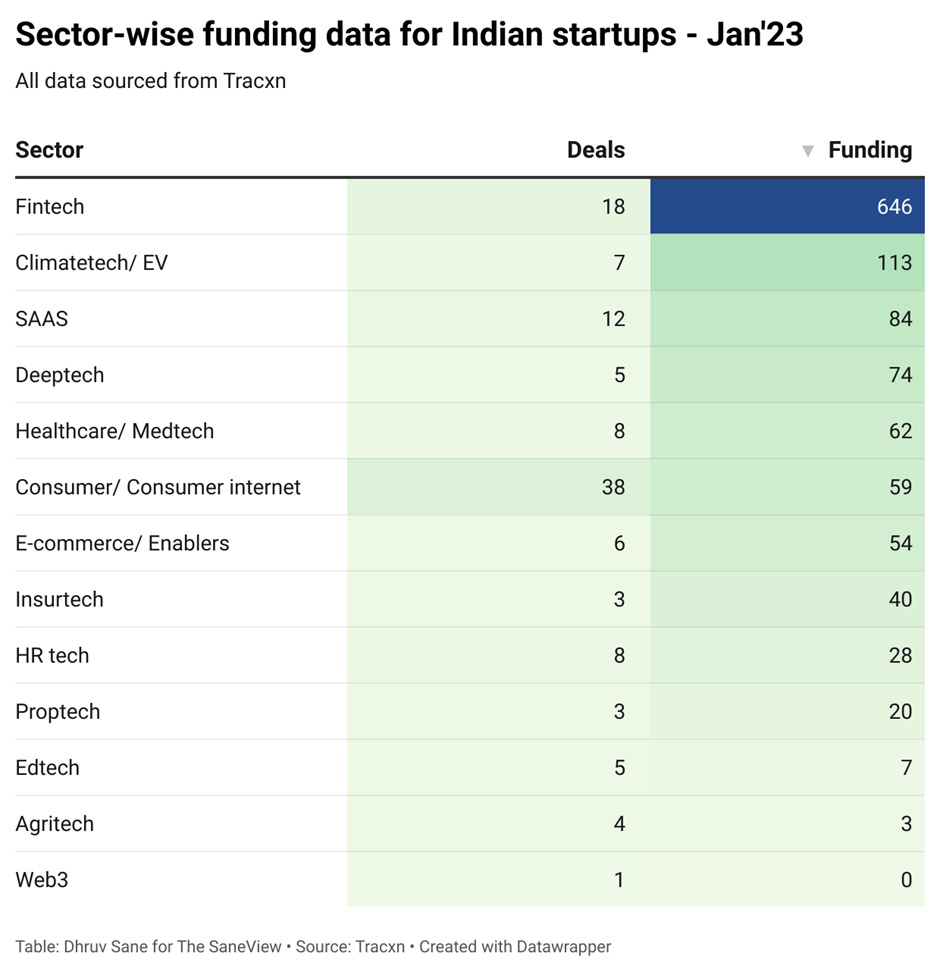

About a third (~30%) of companies raising extension rounds is a clear sign of the pain in the ecosystem. I am sure we will see more such instances in 2023.New-age finance companies continue to pull in the highest amount of funding. Key rounds in the space in January were Kreditbee’s topping up its Series D round by $120 Mn from Advent International resulting in a total raise of $200 Mn and PhonePe raising $350 Mn from General Atlantic. While KreditBee primarily offers personal loans to salaried customers through its partner non-banking financial firms (NBFCs); PhonePe (spin-off from e-commerce startup Flipkart) competes with PayTm in the payments, wallets & lending business.

A key emerging trend is the interest in funding climate-tech startups by investors. The likes of Lightspeed India and Stellaris Venture Partners have shared sector maps and their thesis on the space.

A deal that caught my eye: Rigi

Rigi is a platform that helps creators monetize their audience. Content creators use Rigi to manage WhatsApp and Telegram groups, handle member management, create courses and sell them online, host webinars, and create pay-to-view content, among other use cases. The company raised $12 Mn in January with Elevation Capital leading the round:

Why is the deal interesting?

Well for one, the company is now backed by the crème de le crème of early-stage Indian VCs – Sequoia, Elevation, Accel, Stellaris, and AngelList along with a host of renowned angels. The latest round is in contrast to the global setting where funding for creator economy platforms has slowed down. The Information reported that funding for creator economy startups was down 50% in 2022 vs 2021.

Globally, Rigi will compete with the likes of Kajabi, Teachable, Thinkific, Podia and several other players. Though, it must be said that in India these companies haven’t had much traction. In India, Rigi competes with the likes of Qoohoo amongst other players and looks to be leading the race here.

Finally, the founders (Swapnil Saurav and Ananya Singhal) are a seasoned bunch having previously sold HalaPlay (a fantasy gaming company) to Nazara Technologies.

Over the years, startups have struggled to build venture scale Shopify-like platforms focusing on Indian consumers – Rigi’s journey will certainly be one to watch out for!

Reads on the Indian ecosystem

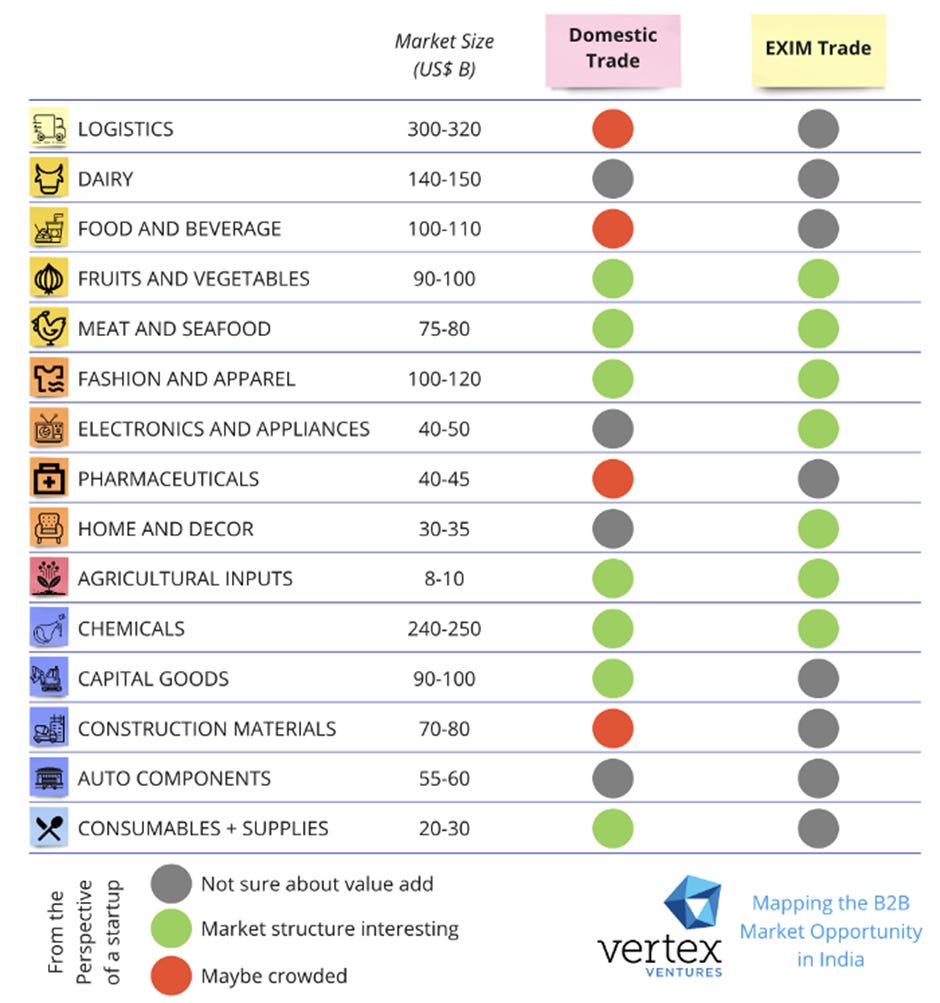

This post by Piyush Kharbanda at Vertex Partners has a lot of good points for anyone focused on B2B Platforms in India. Some points which resonated with me:

…the true definition of margins in B2B commerce is Logistics-adjusted and Net Working Capital-priced Gross Margin...take a simplistic approach: assume that the platform can potentially get working capital financing at 18–24% per annum, and therefore, ascribe a 1.5%-2.0% additional cost for every 30 days of working capital in the value chain

A core decision-making criterion, very much like in software, is customer account growth, without the need to add an army of account managers

The post also shares a very useful chart for mapping out the B2B opportunity for startups in India:

I also enjoyed this paper on Indian Internet marketplaces by Bessemer Venture Partners:

Customer Acquisition Cost (CAC) always goes up with scale: Companies will need to innovate on newer channels of marketing which will be key differentiators to their growth and allow them to keep CAC low. Even today, we see companies have started using short videos, audio, social, influencers, and content to diversify away from vanilla performance channels.

This report complements Piyush’s post and provides useful metrics to evaluate Indian marketplaces:

My monthly opinion:

2023 promises to be a sobering year for the startup ecosystem both in India and abroad. VCs, now more than ever, across the board, are selective about doubling down on startups. Even so, most will be flat rounds or rounds with a slight uptick. Founders will do well to access alternate sources of capital to extend the runway and conserve cash.

Having said so, it is worthwhile to remember, that Indian tech startups continue to pull in more than a billion dollars monthly despite the global slowdown – this number is broadly in line with funding received both in 2019 ($ 15 Bn) and 2020 ($11 Bn). There is enough and more cash to build real businesses!

That’s all from my end for this post – Do let me know your views on this format. I’ll be happy to incorporate new sections basis reader-feedback. Also, do share the post within your network if you found it useful!

I would love your feedback! Do share your comments & questions below or write to me @SaneDhruv on Twitter

This is quite useful, especially in the Indian market where most of the available research is on the US venture capital. Well explained.