A Sane View of Indian Venture – February & March 2023

A roundup of the Indian venture capital ecosystem

Namaste Dear Reader,

I am back with this series reflecting on the state of the Indian venture market over February & March 23. As expected, these months continued to be sobering periods for new investments:

February’23:

Around 75 startups raised USD ~800 Mn in the last month slightly lower than the monthly average of $1 Bn a month being invested in Indian startups over the last 3 quarters:

March’23:

~100 startups raked in USD 1.2Bn during this month; however, this number is inflated by Lenskart’s mega $500 Mn round raised from the Abu Dhabi Investment Authority. If this round is excluded the numbers are largely in line and in some ways poorer than the previous month of Feb’23

I wrote a piece on whether we are under or over-investing in Indian startups via the VC/PE route and surmised that a broad rate of $2 Bn a month via VC will be optimal for growth!

We enjoyed a period of over-indulgence in 2021 and face a period of cautious investment in 2023. Late stage-investors have become selective to back companies with a clear near-term path to IPO.

This is all the more evident today where the Top 3 rounds in each month accounted for more than 50% of capital raised!

The expansion of Series A:

One notable phenomenon emerging through this period is the expansion of round size at Series A. Even excluding the massive $150 Mn raise by InsuranceDekho, the in-house insurance arm of unicorn CarDekho group, 14 startups raised Series A rounds in excess of $10 Mn.

Series A round sizes are likely on the up and up for the foreseeable future. Founders have become wary of future raise-uncertainty and are budgeting for longer runways (24+ months).

In the trade-off between dilution and runway, the tilt today is firmly towards the latter. Moreover, most VCs have raised outsized funds between 2020-22 and have significant reserves to deploy.

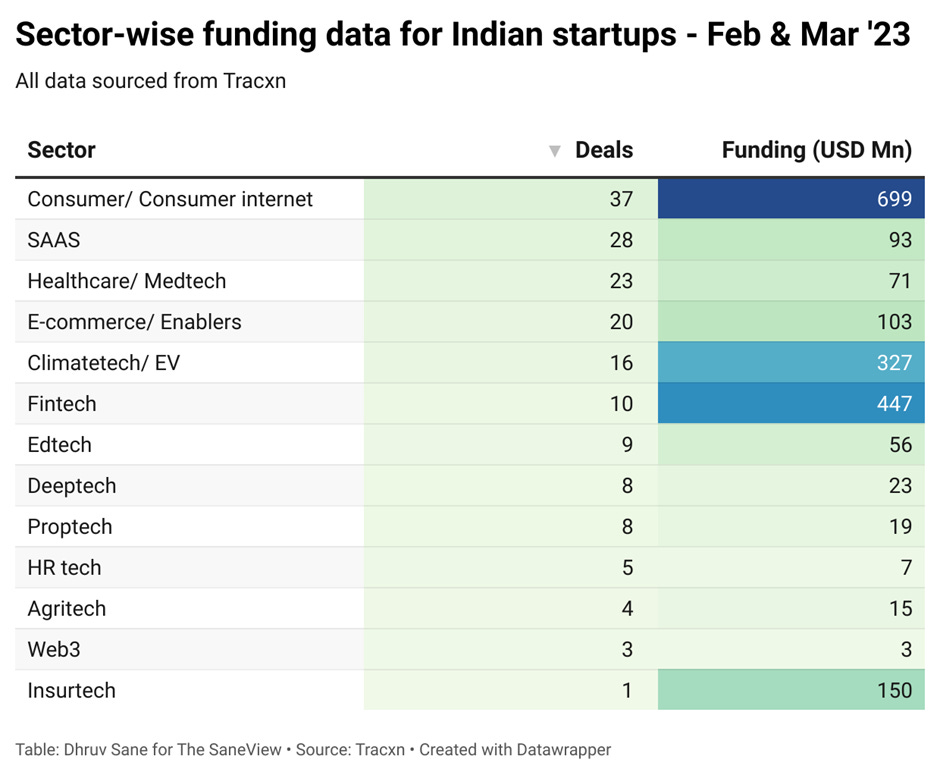

Sectors such as SAAS and Fintech continue to be evergreen sectors for attracting VC investments. The consumer category is inflated due to Lenskart’s 500 Mn round.

EV Investments: In Focus

The emergence of investments in the Electric Vehicles space is prominent. Large investments of existing incumbents (Hero, Bajaj) and other VC-backed players having a head-start have not deterred newer investments given the size of the market. EV 2-wheeler manufacturers (Kaira Mobility, Simple Energy), delivery platforms (Zypp Electric, Magenta Mobility), and E-Cabs (Everacabs) have all attracted large investments. Perhaps, though, the highlight was the investment of up to Rs 1,200 crore by Multiple Private Equity, with its co-investors, TI Clean Mobility, a Murugappa group company, which makes three-wheelers.

Shailendra Singh, founder at Ajjas, shared this chart demonstrating ~3x growth of 2-wheeler sales over the last financial year which demonstrates an increasing customer interest in 2W-EVs:

Reads on the Indian ecosystem

The Indus Valley Report 2023 by Blume and India Venture Capital Report 2023 by Bain & Co were released over the last couple of months and are must-reads for anyone interested in Indian venture.

For those wanting a quick reckoner, Arpit Lahoty,

in this newsletter has covered key points of the Indus Valley Report with his perspectiveRound-up opinion:

Startup founders are correct to be cautious about future investor cash availability and have verily turned the focus on operational profitability. We are likely in an era of geo-political/ macro uncertainty and shall witness rolling crises more than ever before than in the past. On the flipside, this is also a great time to build – limited competition and more discipline in acquiring customers tilt the balance in favour of sound business models.

I’ll end this edition with a couple of Benedict Evans’ presentation reflecting on the present state of venture:

I would love your feedback! Do share your comments & questions below or simply hit reply to this email :)

Until next time!